Kick-off your real estate journey with our in-depth guide to the Real Estate Express Final Exam. We’ll dive into the intricacies of real estate concepts, market analysis, financing, and more, empowering you to conquer your exam and embark on a successful career in real estate.

Get ready to navigate the complexities of real estate transactions, understand the legal framework, and stay ahead with the latest technology innovations shaping the industry.

Real Estate Concepts and Terminology: Real Estate Express Final Exam

Real estate encompasses the land, buildings, and other improvements on it. Understanding its fundamental concepts and terminology is crucial for navigating the industry effectively.

Property types vary widely, from residential homes and commercial buildings to undeveloped land and industrial facilities. Ownership structures define how individuals or entities hold title to a property, including sole ownership, joint tenancy, and tenancy in common.

Legal Documents

Legal documents play a vital role in real estate transactions. These include:

- Purchase agreement:Artikels the terms and conditions of a property sale, including the purchase price, financing details, and closing date.

- Deed:Transfers ownership of a property from one party to another.

- Mortgage:A loan secured by real estate, used to finance a property purchase.

Common Real Estate Transactions

Common real estate transactions include:

- Buying:Acquiring ownership of a property through a purchase agreement and deed transfer.

- Selling:Transferring ownership of a property to a new buyer through a sale agreement and deed.

- Leasing:Granting temporary possession and use of a property to a tenant in exchange for rent payments.

Role of Real Estate Agents and Brokers

Real estate agents and brokers facilitate transactions between buyers and sellers. Agents typically represent one party in a transaction, while brokers represent both parties. They provide expertise, market knowledge, and legal guidance throughout the process.

Real Estate Market Analysis

Conducting a market analysis is crucial for determining property values, understanding market trends, and making informed real estate decisions. By considering various factors and employing reliable methods, investors and professionals can gain insights into the current and future performance of the real estate market.

Factors Influencing Real Estate Values

Several factors play a significant role in shaping real estate values, including:

- Location:The desirability and accessibility of a property’s location influence its value. Factors like proximity to amenities, transportation, and employment centers are key considerations.

- Amenities:The availability of amenities, such as schools, parks, shopping centers, and recreational facilities, can enhance property values by increasing the desirability and convenience of a location.

- Economic Conditions:The overall economic health of a region, including employment rates, income levels, and interest rates, can impact real estate values. Strong economic conditions typically lead to higher demand and increased property values.

- Property Characteristics:The physical attributes of a property, such as its size, condition, age, and design, also influence its value.

- Market Supply and Demand:The balance between the number of properties available for sale or rent (supply) and the number of buyers or renters seeking properties (demand) affects market prices.

Real Estate Financing

Real estate financing involves obtaining funds to purchase or refinance a property. It plays a crucial role in real estate transactions, allowing individuals and investors to acquire properties without paying the entire cost upfront.

Types of Real Estate Financing

There are various types of real estate financing options available, each with its own terms and conditions:

- Mortgages:Loans secured by the property being purchased, typically with a fixed or adjustable interest rate and a set repayment period.

- Loans:Funds borrowed from a lender, often secured by collateral other than the property being purchased, with varying interest rates and repayment terms.

- Equity Investments:Investments in a property where the investor receives a share of ownership and profits, usually requiring a higher down payment and carrying more risk.

Obtaining Financing

The process of obtaining financing for real estate purchases typically involves:

- Pre-approval for a mortgage or loan, which estimates the amount you can borrow based on your financial situation.

- Submitting a formal loan application, providing detailed financial information and documentation.

- Loan underwriting, where the lender evaluates your application and assesses the risk of lending you money.

- Loan approval, subject to meeting the lender’s conditions and providing additional documentation as needed.

- Fixed-Rate Mortgages:Interest rates remain constant throughout the loan term, providing stability in monthly payments.

- Adjustable-Rate Mortgages (ARMs):Interest rates fluctuate based on market conditions, potentially leading to lower or higher monthly payments over time.

- Government-Backed Loans (FHA, VA, USDA):Loans insured by the government, offering lower down payment requirements and more flexible credit guidelines.

- Virtual Reality (VR) and Augmented Reality (AR):VR and AR create immersive experiences, allowing buyers to explore properties remotely and visualize renovations or remodels.

- Artificial Intelligence (AI):AI automates tasks such as property valuation, market analysis, and lead generation, freeing up real estate professionals to focus on client relationships.

- Blockchain:Blockchain provides a secure and transparent platform for real estate transactions, streamlining processes and reducing the risk of fraud.

Loan Products

Different loan products have varying terms and conditions that can impact your monthly payments, interest rates, and repayment period:

Real Estate Ethics and Professionalism

Real estate professionals have a fiduciary duty to their clients, which means they must act in their clients’ best interests. This includes maintaining confidentiality, avoiding conflicts of interest, and providing fair and honest advice. Real estate professionals must also comply with all applicable laws and regulations.

Maintaining Confidentiality, Real estate express final exam

Real estate professionals must maintain the confidentiality of all information they receive from their clients. This includes personal and financial information, as well as any information about the property that is not publicly available. Real estate professionals must not disclose this information to anyone else without the client’s consent.

Avoiding Conflicts of Interest

Real estate professionals must avoid any conflicts of interest that could impair their ability to act in their clients’ best interests. For example, a real estate professional should not represent both the buyer and the seller in the same transaction.

Real estate professionals must also disclose any potential conflicts of interest to their clients.

The Real Estate Express final exam can be a daunting task, but it’s essential to prepare thoroughly. While studying for the exam, take a break to check out Jack’s Wife Freda gluten-free for a delicious treat. When you return to your studies, you’ll be refreshed and ready to conquer the Real Estate Express final exam with confidence.

Providing Fair and Honest Advice

Real estate professionals must provide fair and honest advice to their clients. This means they must not exaggerate the value of a property or make any false or misleading statements. Real estate professionals must also disclose any known defects or problems with a property to their clients.

Resources for Real Estate Professionals

There are a number of resources available to help real estate professionals stay up-to-date on ethical best practices. These resources include the National Association of Realtors (NAR) Code of Ethics, the Real Estate Ethics Center, and the Association of Real Estate License Law Officials (ARELLO).

Real Estate Technology and Innovation

Technology is revolutionizing the real estate industry, transforming the way properties are bought, sold, and managed. From virtual reality tours to blockchain-based transactions, innovation is enhancing efficiency, transparency, and accessibility in real estate.

Emerging Technologies

Several emerging technologies are shaping the real estate landscape:

FAQ Corner

What are the key concepts covered in the Real Estate Express Final Exam?

The exam encompasses various aspects of real estate, including property types, ownership structures, legal documents, market analysis, financing options, legal regulations, ethics, and technology.

How can I prepare effectively for the exam?

Thoroughly review the course materials, practice with sample questions, and seek guidance from experienced professionals or tutors.

What is the passing score for the Real Estate Express Final Exam?

The passing score may vary depending on the jurisdiction and exam provider. Typically, a score of 70-80% is required to pass.

Can I retake the exam if I fail?

Yes, you may be allowed to retake the exam if you do not pass on your first attempt. However, there may be a waiting period or additional fees involved.

What resources are available to help me succeed in the exam?

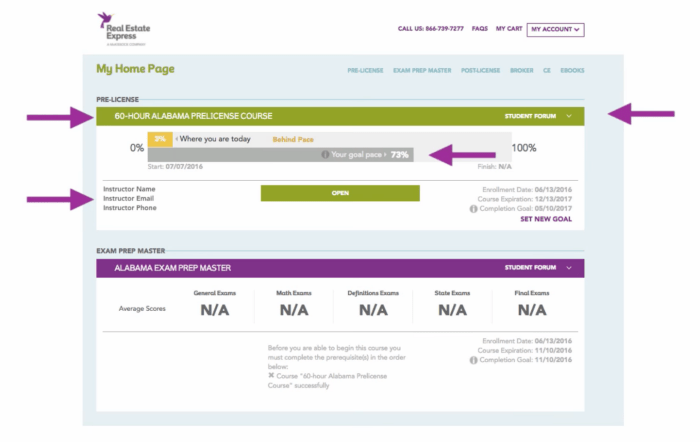

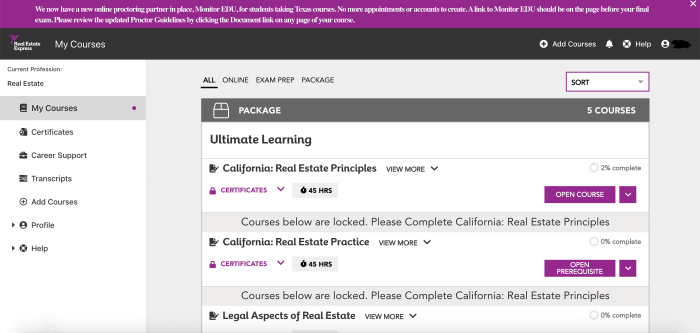

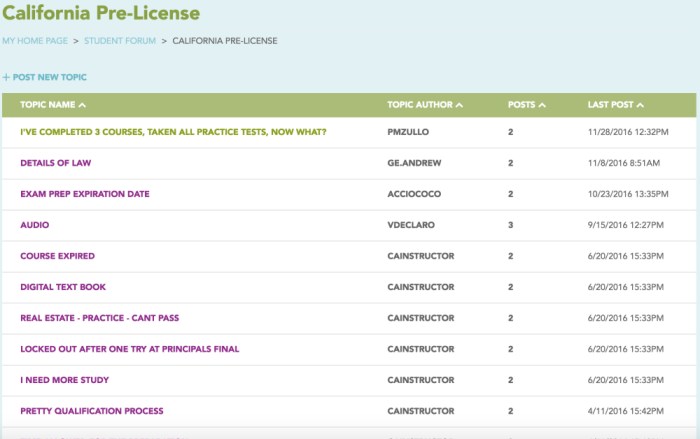

Real Estate Express provides study materials, practice tests, and online support. Additionally, you can consult textbooks, attend workshops, or join study groups.